Page 60 - Plano, TX Heritage Preservation Plan

P. 60

CITY INCENTIVE PROGRAMS: HERITAGE TAX EXEMPTION

PROGRAM

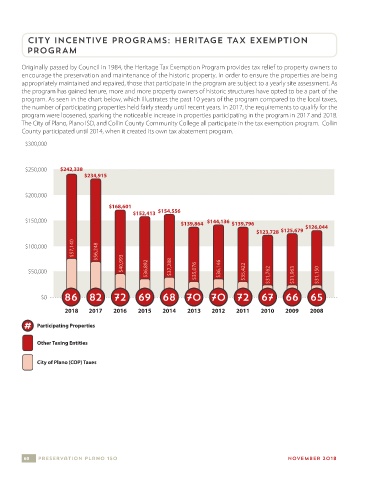

Originally passed by Council in 1984, the Heritage Tax Exemption Program provides tax relief to property owners to

encourage the preservation and maintenance of the historic property. In order to ensure the properties are being

appropriately maintained and repaired, those that participate in the program are subject to a yearly site assessment. As

the program has gained tenure, more and more property owners of historic structures have opted to be a part of the

program. As seen in the chart below, which illustrates the past 10 years of the program compared to the local taxes,

the number of participating properties held fairly steady until recent years. In 2017, the requirements to qualify for the

program were loosened, sparking the noticeable increase in properties participating in the program in 2017 and 2018.

The City of Plano, Plano ISD, and Collin County Community College all participate in the tax exemption program. Collin

County participated until 2014, when it created its own tax abatement program.

$300,000

$250,000 $242,338

$234,915

$200,000

$168,601

$152,413 $154,556

$150,000 $144,136

$139,864 $139,796 $126,044

$123,728 $125,679

$57,140 $56,248

$100,000

$50,000 $40,993 $36,892 $37,288 $35,076 $36,146 $35,422 $31,762 $31,963 $31,150

$0 86 82 72 69 68 70 70 72 67 66 65

2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008

Participating Properties

Other Taxing Entities

City of Plano (COP) Taxes

60 Preservation Plano 150 NOVEMBER 2018