Page 61 - Plano, TX Heritage Preservation Plan

P. 61

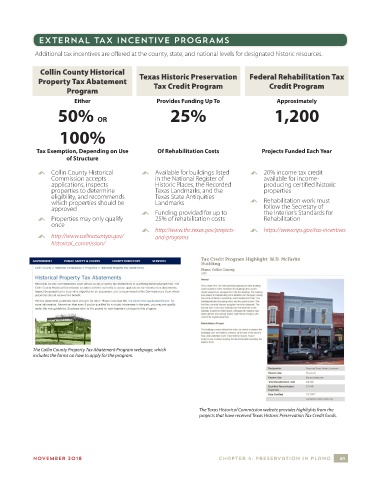

EXTERNAL TAX INCENTIVE PROGRAMS

Additional tax incentives are offered at the county, state, and national levels for designated historic resources.

Collin County Historical

Property Tax Abatement Texas Historic Preservation Federal Rehabilitation Tax

Credit Program

Tax Credit Program

Program

Either Provides Funding Up To Approximately

50% OR 25% 1,200

100%

Tax Exemption, Depending on Use Of Rehabilitation Costs Projects Funded Each Year

of Structure

A Collin County Historical A Available for buildings listed A 20% income tax credit

Commission accepts in the National Register of available for income-

applications, inspects Historic Places, the Recorded producing certified historic

properties to determine Texas Landmarks, and the properties

eligibility, and recommends Texas State Antiquities

which properties should be Landmarks A Rehabilitation work must

approved follow the Secretary of

A Funding provided for up to the Interior’s Standards for

A Properties may only qualify 25% of rehabilitation costs Rehabilitation

once

A http://www.thc.texas.gov/projects- A https://www.nps.gov/tax-incentives

A http://www.collincountytx.gov/ and-programs

historical_commission/

The Collin County Property Tax Abatement Program webpage, which

includes the forms on how to apply for the program.

The Texas Historical Commission website provides highlights from the

projects that have received Texas Historic Preservation Tax Credit funds.

NOVEMBER 2018 chapter 4: preservation in plano 61