Page 191 - Littleton, CO Comprehensive Plan

P. 191

Fiscal Impact Analysis

The City of Littleton, CO

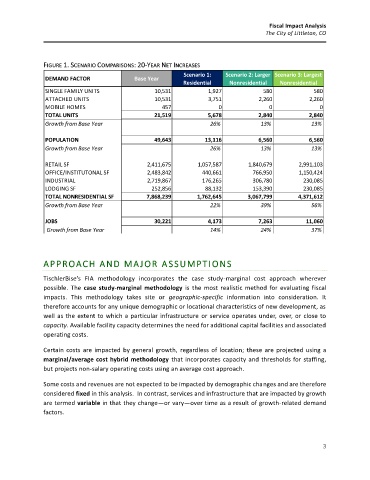

FIGURE 1. SCENARIO COMPARISONS: 20-YEAR NET INCREASES GROWTH OVER BASE YEAR (2019)

Scenario 1: Scenario 2: Larger Scenario 3: Largest

DEMAND FACTOR Base Year

Residential Nonresidential Nonresidential

SINGLE FAMILY UNITS 10,531 1,927 580 580

ATTACHED UNITS 10,531 3,751 2,260 2,260

MOBILE HOMES 457 0 0 0

TOTAL UNITS 21,519 5,678 2,840 2,840

Growth from Base Year 26% 13% 13%

POPULATION 49,643 13,116 6,560 6,560

Growth from Base Year 26% 13% 13%

RETAIL SF 2,411,675 1,057,587 1,840,679 2,991,103

OFFICE/INSTITUTONAL SF 2,483,842 440,661 766,950 1,150,424

INDUSTRIAL 2,719,867 176,265 306,780 230,085

LODGING SF 252,856 88,132 153,390 230,085

TOTAL NONRESIDENTIAL SF 7,868,239 1,762,645 3,067,799 4,371,612

Growth from Base Year 22% 39% 56%

JOBS 30,221 4,173 7,263 11,060

Growth from Base Year 14% 24% 37%

APPROACH AND MAJOR A SSUMPTIONS

TischlerBise’s FIA methodology incorporates the case study-marginal cost approach wherever

possible. The case study-marginal methodology is the most realistic method for evaluating fiscal

impacts. This methodology takes site or geographic-specific information into consideration. It

therefore accounts for any unique demographic or locational characteristics of new development, as

well as the extent to which a particular infrastructure or service operates under, over, or close to

capacity. Available facility capacity determines the need for additional capital facilities and associated

operating costs.

Certain costs are impacted by general growth, regardless of location; these are projected using a

marginal/average cost hybrid methodology that incorporates capacity and thresholds for staffing,

but projects non-salary operating costs using an average cost approach.

Some costs and revenues are not expected to be impacted by demographic changes and are therefore

considered fixed in this analysis. In contrast, services and infrastructure that are impacted by growth

are termed variable in that they change—or vary—over time as a result of growth-related demand

factors.

3