Page 218 - Littleton, CO Comprehensive Plan

P. 218

Fiscal Impact Analysis

The City of Littleton, CO

FURTHER DETAIL ON OP ERATING AND CAPITAL RESULTS

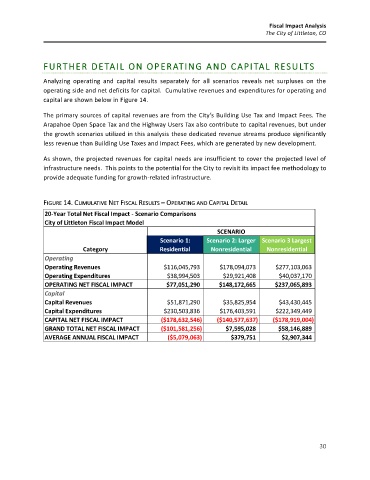

Analyzing operating and capital results separately for all scenarios reveals net surpluses on the

operating side and net deficits for capital. Cumulative revenues and expenditures for operating and

capital are shown below in Figure 14.

The primary sources of capital revenues are from the City’s Building Use Tax and Impact Fees. The

Arapahoe Open Space Tax and the Highway Users Tax also contribute to capital revenues, but under

the growth scenarios utilized in this analysis these dedicated revenue streams produce significantly

less revenue than Building Use Taxes and Impact Fees, which are generated by new development.

As shown, the projected revenues for capital needs are insufficient to cover the projected level of

infrastructure needs. This points to the potential for the City to revisit its impact fee methodology to

provide adequate funding for growth-related infrastructure.

FIGURE 14. CUMULATIVE NET FISCAL RESULTS – OPERATING AND CAPITAL DETAIL

20-Year Total Net Fiscal Impact - Scenario Comparisons

City of Littleton Fiscal Impact Model

SCENARIO

Scenario 1: Scenario 2: Larger Scenario 3 Largest

Category Residential Nonresidential Nonresidential

Operating

Operating Revenues $116,045,793 $178,094,073 $277,103,063

Operating Expenditures $38,994,503 $29,921,408 $40,037,170

OPERATING NET FISCAL IMPACT $77,051,290 $148,172,665 $237,065,893

Capital

Capital Revenues $51,871,290 $35,825,954 $43,430,445

Capital Expenditures $230,503,836 $176,403,591 $222,349,449

CAPITAL NET FISCAL IMPACT ($178,632,546) ($140,577,637) ($178,919,004)

GRAND TOTAL NET FISCAL IMPACT ($101,581,256) $7,595,028 $58,146,889

AVERAGE ANNUAL FISCAL IMPACT ($5,079,063) $379,751 $2,907,344

30