Page 221 - Littleton, CO Comprehensive Plan

P. 221

Fiscal Impact Analysis

The City of Littleton, CO

A P PENDIX A: REVENUE AND COST DETAIL

A summary of projected revenues and costs from future growth/development in the city is provided

below. These figures are based on the development projections and the revenue and cost factors

described elsewhere in this report.

REVENUES

REVENUE PROJECTION METHODOLOGIES

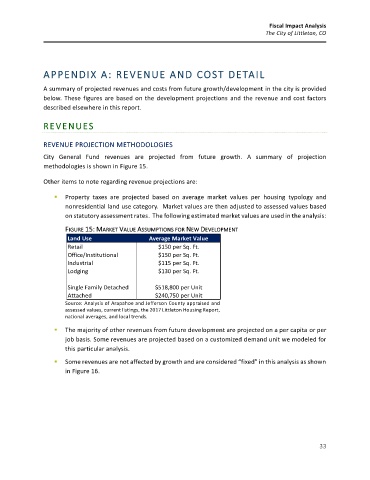

City General Fund revenues are projected from future growth. A summary of projection

methodologies is shown in Figure 15.

Other items to note regarding revenue projections are:

▪ Property taxes are projected based on average market values per housing typology and

nonresidential land use category. Market values are then adjusted to assessed values based

on statutory assessment rates. The following estimated market values are used in the analysis:

FIGURE 15: MARKET VALUE ASSUMPTIONS FOR NEW DEVELOPMENT

Land Use Average Market Value

Retail $150 per Sq. Ft.

Office/Institutional $150 per Sq. Ft.

Industrial $115 per Sq. Ft.

Lodging $130 per Sq. Ft.

Single Family Detached $518,800 per Unit

Attached $240,750 per Unit

Source: Analysis of Arapahoe and Jefferson County appraised and

assessed values, current listings, the 2017 Littleton Housing Report,

national averages, and local trends.

▪ The majority of other revenues from future development are projected on a per capita or per

job basis. Some revenues are projected based on a customized demand unit we modeled for

this particular analysis.

▪ Some revenues are not affected by growth and are considered “fixed” in this analysis as shown

in Figure 16.

33